Forge ITSM Workflows for the Banking Industry

With KEDAR, banks can unify service delivery, compliance, and asset management on a single secure platform. From managing critical IT operations to ensuring regulatory adherence, KEDAR streamlines workflows, reduces risk, and strengthens resilience. The result is faster resolutions, smarter governance, and reliable services that keep financial operations running smoothly and customers’ trust intact.

The Evolving Landscape of Banking & Financial Services

An increasingly mobile and tech-savvy customer base, combined with the rise of fintech and digital-native players, has fueled cutthroat competition in financial services. At the same time, new regulations and consumer-driven expectations are pushing banks to invest heavily in technologies that deliver superior customer experiences. In this environment, exceptional customer service and uncompromising security have become the key differentiators.

While digital transformation is well underway, many banks and financial institutions still have significant ground to cover. Success depends heavily on IT departments, which now carry the responsibility of keeping business-critical systems running, protecting sensitive data, and enabling enterprise services 24/7. The disruptions brought on by the pandemic accelerated this urgency, forcing banks to adapt quickly to remote work, digital-first customer engagement, and heightened security requirements.

But without a modern, integrated service management platform that aligns with ITIL and industry best practices, IT teams face an uphill battle. Siloed systems, reactive service models, and lack of visibility slow down transformation, hinder agility, and risk undermining customer trust.

KEDAR helps banks overcome these hurdles with a unified platform for service management, asset visibility, compliance, and customer-centric service delivery. By automating workflows, integrating enterprise services, and enabling proactive incident and change management, KEDAR empowers financial institutions to accelerate digital transformation, strengthen resilience, and deliver remarkable end-user and customer experiences.

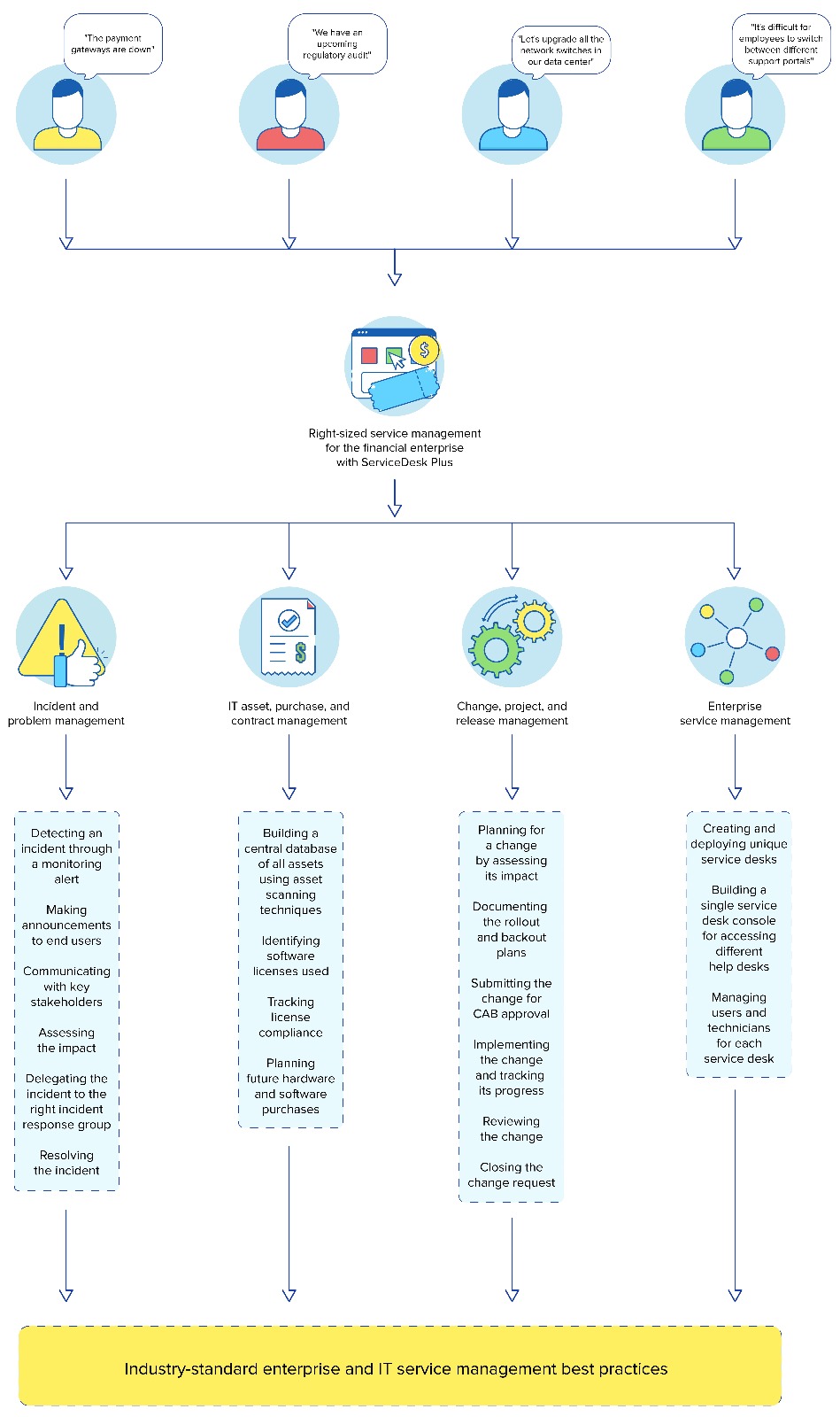

Firefighting Critical Incidents in Banking — and Moving Beyond

In financial services, uptime isn’t optional — it’s everything. From credit cards and ATMs to payment gateways and online banking, nearly every customer-facing interaction runs on IT. Behind the scenes, banks and financial institutions safeguard vast troves of personal and financial data, spread across on-premises systems and the cloud.

When downtime strikes, the consequences are immediate and costly: lost revenue, diminished trust, and regulatory penalties that can reach into billions. Without a proactive incident and problem management strategy, IT teams are left firefighting, and institutions risk grinding to a halt. KEDAR’s ITSM platform helps banks shift from reactive chaos to proactive resilience — detecting issues early, automating resolution, and keeping critical services always available.

Monitoring and Managing a Complex IT Environment

Banks and financial institutions operate sprawling IT landscapes: core data centers, far-flung branches, disparate IP/MLS networks, and hundreds of interconnected applications. To deliver reliable customer services, IT must ensure peak performance of every asset while complying with stringent standards like HIPAA, SOX, FDICIA, ISO 27002, and SOC 1–3.

With KEDAR, IT teams gain end-to-end visibility of their infrastructure through a comprehensive CMDB, mapping dependencies across workstations, servers, switches, and applications. Integrated ITOM capabilities provide advanced monitoring, device management, and network health checks — all orchestrated centrally to prevent silos. This unified view enables faster compliance reporting, smarter change management, and risk-free large-scale releases.

Delivering a Consistent Service Experience

In financial services, customer experience starts with employee experience. CXOs know that when employees are supported effectively, customers feel the difference. But too often, banks rely on outdated, generic ITSM tools that overload service desks with trivial tickets and fail to provide clarity on entitlements.

KEDAR’s enterprise service desk delivers a consumer-grade experience for employees, offering:

• Personalized service catalogs tailored by role, department, and location.

• Unified self-service portals for requests, knowledge articles, and approvals.

• Smart automation to deflect trivial requests and speed up complex ones.

By streamlining employee interactions, banks improve internal efficiency, stay compliant with governance and information security standards, and ultimately deliver better service to customers.

Navigating the Future of Work

The pandemic redefined the workplace, and banks have embraced hybrid and remote models as the new norm. Giants like Citibank now mix flexible work with on-site requirements and IT must support this shift without compromising security or compliance.

With KEDAR, financial institutions can:

• Enforce secure remote access policies and provision assets for hybrid teams.

• Manage onboarding, offboarding, payroll, insurance renewals, and facilities from a single platform.

• Keep employees productive with a seamless, secure digital workplace.

By centralizing enterprise services, KEDAR eliminates the inefficiencies of fragmented tools and ensures agility, security, and employee satisfaction in equal measure.

The KEDAR Advantage for Banking & Financial Services

Legacy ticketing systems no longer cut it in a world where every second of uptime counts. KEDAR’s full-stack ITSM platform equips banks and financial institutions to:

• Proactively manage incidents and minimize downtime.

• Gain complete visibility and control over IT infrastructure.

• Ensure compliance with strict financial regulations.

• Deliver a consistent, consumer-grade employee experience.

• Support hybrid workplaces with secure, centralized enterprise services.

With KEDAR, banks can balance operational agility with uncompromising security and deliver the always-on services that customers expect — while keeping regulators satisfied and employees empowered.

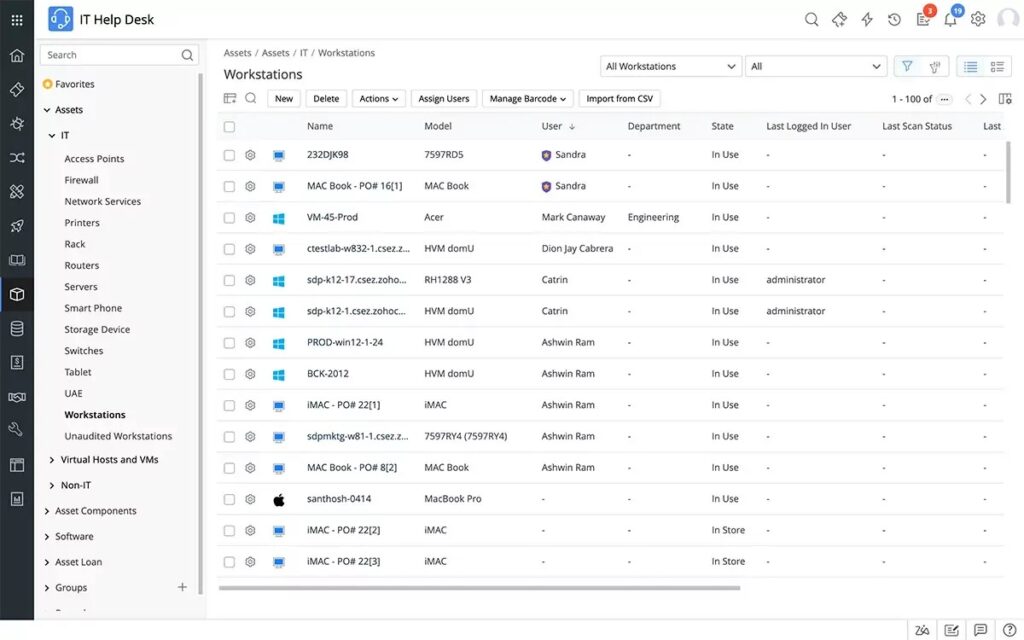

Implement an ITAM Strategy That Works Seamlessly with ITSM

Banks and financial institutions manage sprawling IT estates, often distributed across regions and governed by strict compliance requirements. With KEDAR’s IT Asset Management (ITAM) module, you can unify IT and non-IT asset visibility, strengthen governance, and reduce operational risks while maintaining full compliance.

• Discover assets automatically across Windows, Linux, and macOS devices with a unified agent.

• Track license compliance and asset depreciation to optimize spending and stay audit-ready.

• Leverage real-time dashboards for inventory and software usage optimization.

• Provide advanced remote support to employees anywhere, anytime.

• Map dependencies among people, assets, and services with a comprehensive CMDB for deeper visibility.

• Detect unauthorized software to ensure compliance and minimize security risks.

Minimize Risks and Costs with Structured Change Management

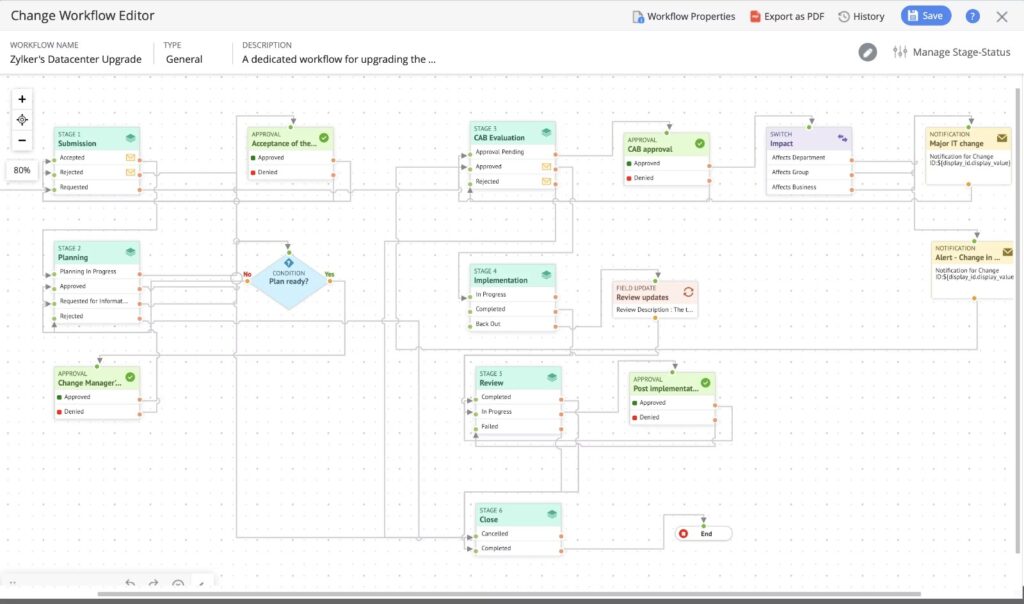

Modern banking relies on rapid innovation but implementing changes without structure risks downtime, compliance issues, and financial loss. With KEDAR’s Change and Project Management, you simplify and accelerate change processes while ensuring alignment with ITSM best practices.

• Plan and design change workflows for minor, major, and emergency changes on a drag-and-drop canvas.

• Automate each stage with rule-based approvals, notifications, and field updates.

• Associate projects directly with change tickets to keep large-scale changes on track.

• Gain real-time visibility into change initiatives with integrated reporting and analytics.

By tying ITAM and change management directly into ITSM, KEDAR gives banks the governance, control, and agility needed to cut costs, minimize risk, and deliver secure, uninterrupted financial services.